From 1st October all UK Banks and Building Societies are required to produce the LCR under the new delegated act. To help bring clarity to the new delegated act and address the key points which affect small banks and building societies ALMIS® International, already experts in delivering an automated solution, hosted a highly informative and interactive webinar on Tuesday 29th September, attended by 58 delegates.

The webinar was led by Joe Di Rollo (Managing Director) of ALMIS® International and covered the main points for completing and calculating the new LCR.

This webinar was very relevant to understanding and navigating the issues posed by the new CRD IV liquidity regime which came into force on 1st October. There is definitely an appetite for greater understanding of the new regime and discussion of the more complex and ambiguous issues, as evidenced by the high turnout from both banks and building societies. Everyone agreed on the need for clarity in order to achieve effective compliance and best practice.

The webinar focused on the main points for completing and calculating the LCR and highlighted some key issues.

Key Issues

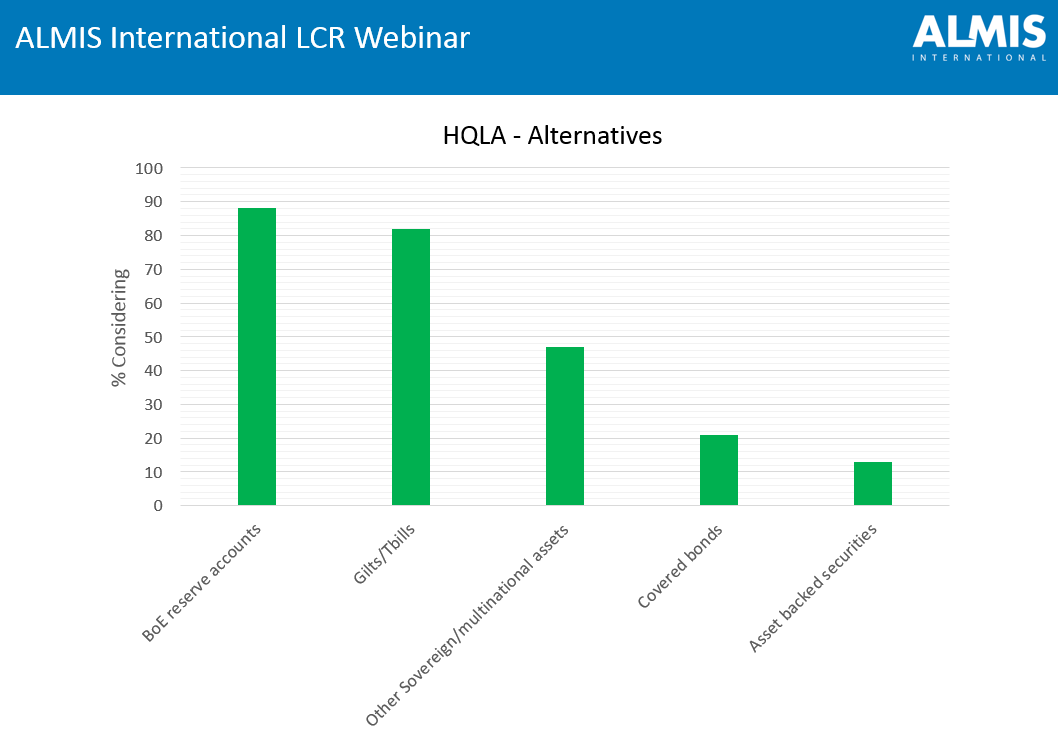

There is now increased choice for investing in HQLA’s (High Quality Liquid Assets). Delegates were asked which instruments they are considering. The results are captured in the graph below:

Outflows are the most complex part of the return with some interesting differences in interpretation. One example of different opinions in interpretation discussed at the webinar is detailed below:

If a customer has a balance greater than the FSGS limit (shortly to be £75,000) should the entire balance be treated as a higher risk outflow of 10% or only the portion of the balance above the insured amount?

The EBA FINAL draft implementing technical standards states:

1.1.1.2 Deposits subject to higher outflows

“Credit institutions shall report here the full balance of the deposits subject to higher outflow rates in accordance with paragraph 2 and 3 of Article 25 of Commission delegated regulation (EU) 2015/61. Those retail deposits where the assessment under paragraph 2 of Article 25 for their categorization has not been carried out or is not completed shall also be reported here”.

This wording suggests that the intent is for the entire balance to be considered non-stable.

On the other hand…

Article 25 para 1 – Credit institutions shall multiply by 10% other retail deposits, including that part of retail deposits not covered by Article 24.

Firms are interpreting this to mean that only the excess over the guarantee is subject to the higher outflow.

ALMIS® software is designed to handle both interpretations.

In summary, ALMIS® is already a fully automated solution which produces the LCR from core data. This same core data is used for liquidity adequacy and analysis, providing a reliable, automated system to help ensure efficient compliance with the new regulations, regardless of interpretation.

For the presentation slides, please contact Jenna Haston by email on [email protected] or call on 0131 452 8898.