BCBS Consultation Paper – Recalibration of shocks for interest rate in the banking book

In February this year, the Basel Committee on Banking Supervision (BCBS) released consultative document for recalibration of shocks for interest rate risk in the banking book, issued for comment by 28 March 2024.

In April 2016 the Basel Committee published its standard on interest rate risk in the banking book (IRRBB), which was most recently updated with SPR98 on 15 December 2019. The standard requires banks to calculate measures of interest rate risk for their banking book exposures with the measures based on a specified set of interest rate shocks for each currency for which the bank has material positions. The Committee noted the severity of the specified shocks would be subject to periodic review. The purpose of December 2023’s Consultative Document is to detail a set of prescribed adjustments to the specified interest rate shocks in the IRRBB standard, alongside adjustments to the current methodology used to calculate the shocks. These changes are deemed necessary to address problems with how the current methodology captures interest rate changes during periods when rates are close to zero due to fundamental shortcomings in basic risk management of traditional interest rate risk.

Current Interest Rate Shocks

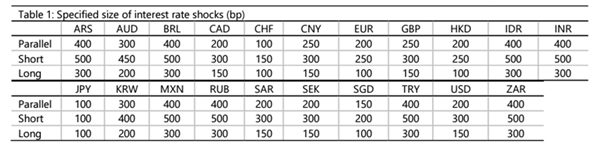

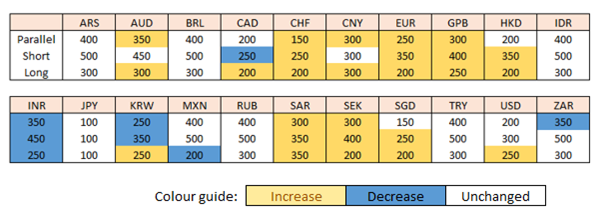

The IRRBB standard requires banks to apply specified interest rate shocks to risk-free yield curves for each currency for which the bank has material positions. Under the standardised approach, banks must determine the impact of these shocks on their economic value of equity (EVE) and net interest income (NII). The shocks that must be applied to the risk-free yield curve for each currency is set out in the following table, which is derived from historical data during the period from January 2000 to December 2015:

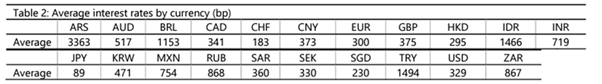

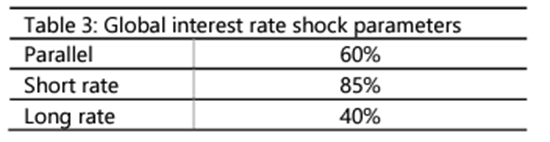

The methodology used to produce the specified shocks combined three elements: (i) average interest rates for each currency; (ii) global shock parameters that are applied to the average rates for each currency; and, (iii) application of a floor, a set of caps and rounding.

Average interest rates were calculated for each currency using interest rate data from the calculation period, covering tenors from 3 months to 20 years:

The next step used to calculate the specified shocks was to multiply the average interest rates by the following set of global shock parameters:

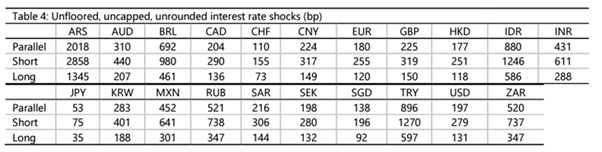

Applying the global shock factors to the average interest rates for each currency gives the following unfloored, uncapped, unrounded interest rate shocks:

The IRRBB standard notes in SPR98.60 that the methodology can lead to unrealistically low interest rate shocks for some currencies and to unrealistically high shocks for others. To ensure a minimum level of prudence and a level playing field, a floor and a set of caps are applied. The floor is set at 100bp and the caps are set at 400bp for the parallel shock, 500bp for the short-term shock and 300bp for the long-term shock. Finally, the amounts are rounded to the nearest 50bp.

Problems with methodology used to calculate global shock parameters

The main objective of the Committee’s review of the interest rate shocks in the IRRBB standard was to update the interest rate data that is used in the calibration of the shocks. The current standard uses data from the period January 2000 to December 2015 and the Committee would like to extend that period to cover the period January 2000 to December 2022. Expending the period used, however, reveals a problem with the above methodology for calculating global shock parameter.

The shock parameters are generated from the average of 99th and 1st percentiles of rolling six-month percentage changes in interest rates (i.e. [rate in six months – current rate] / current rate). When rates are close to zero, the rate of change can be very large. For example, when the rate went down from 0.02% to 0.001% (0.019% difference) in six-months for a certain currency, the shock parameter is 95%. In another example, however, when the rate went up from 5.5% to 5.519% (the same 0.019% difference), the shock parameter is just 0.35%. The same calculation generates huge differences depending on the original level of interest rates. Therefore, in addition to updating the data period used to calibrate the interest rate shock parameters, the Committee has agreed to propose revisions to the way the shock parameters are calculated.

Comparison of existing and new methodology

- Expansion of the time series used in the calibration from December 2015 to December 2022.

- Removal of the global shock factors calculated using rolling six-month percentage changes in interest rates. These are replaced with local shock factors calculated directly for each currency using the averages of absolute changes in interest rates calculated over a rolling six-month period.

- Move from a 99th percentile value in determining the shock factor to a 99.9th percentile value, to maintain sufficient conservatism in the proposed recalibration.

The table below shows the interest rate shock parameters calculated using the proposed new methodology, with the data through to end-2022. The colours in the table show whether the shock sizes under the proposed new methodology results in an increase, decrease or are unchanged relative to the existing shock factors:

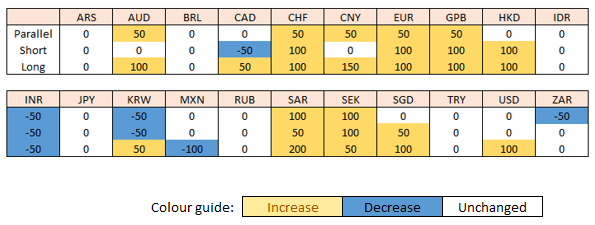

The following table quantifies the impact of the proposed change to the interest rate shock of each currency:

For most currencies the standard shocks have increased, e.g. the current 250bps parallel shock for GBP and 200bps parallel shock for EUR are proposed to increase to 300bps and 250bps respectively. If introduced, this would likely lead to banks revisiting their IRRBB framework including risk appetite, modelling, and hedging capacity

About the Author

Luke Di Rollo , Chief Product Officer, is a seasoned professional in the banking industry with nearly a decade of experience specialising in Asset and Liability Management (ALM) and Interest Rate Risk in the Banking Book (IRRBB). Throughout his career, he has developed and implemented several widely adopted models within the UK banking sector. Luke holds a CertBALM qualification and is a member of the Association of Corporate Treasurers (ACT), underscoring his expertise and commitment to the field.

ALMIS® International has a team of experts in bank Asset Liability Management, Regulatory Reporting, Hedge Accounting and Treasury Management supporting over 65 Financial Institutions. Please get in touch to learn more about how we can help.