Edinburgh Wednesday 11th August 2021: ALMIS® International, the Edinburgh-based asset liability and treasury management software developer, has announced the appointment of its first Chief Technical Officer to spearhead innovation and development for the regulatory compliance of banks and building societies.

Chris Smith, aged 42, has more than 20 years’ experience in solutions architecture, and software development infrastructure, joins ALMIS® International from Cegedim Healthcare Solutions, an innovative technology and services company providing management software suites to GP Surgeries and Pharmacies across the UK.

In recent years, there has been a steady increase in a global regulatory focus on technology and innovation as regulators look to shore up procedural compliance.

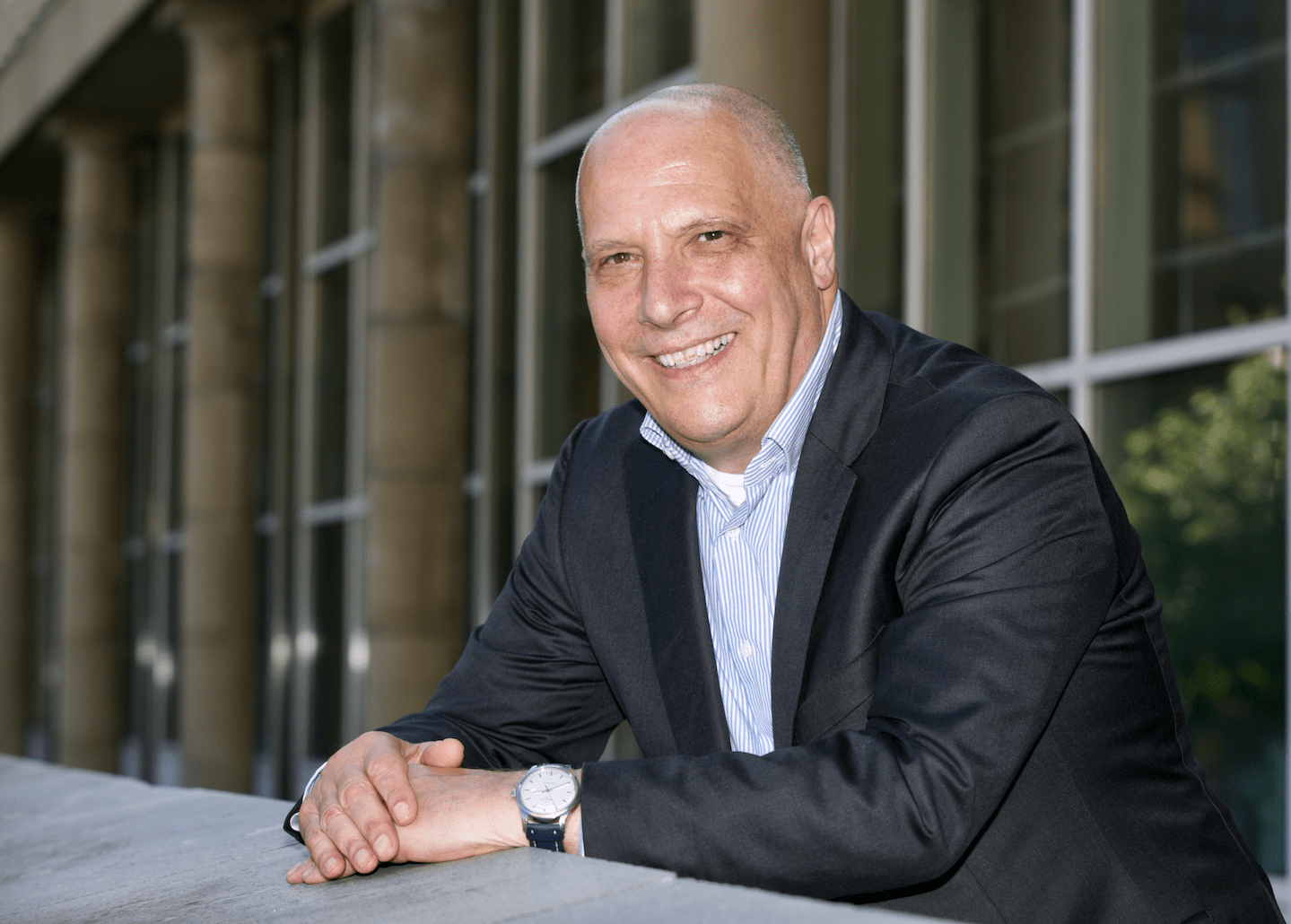

The company has positioned itself as one of the key software developers in this field and as Joe DiRollo, founder and managing director of ALMIS® International explains, the appointment of a Chief Technology Officer to oversee future incremental development of the product suite to comply with the regulatory demands placed on banks and building societies, helps ALMIS® maintain its position as a prominent corporate financial software developer.

He comments,

“We are delighted to welcome Chris Smith as ALMIS® International’s new Chief Technology Officer. “For some time, we have been searching for the right candidate who could drive through our medium to long term product development strategy. Chris comes with a wealth of knowledge and experience, creating and developing software in industries such as forestry and healthcare. He’ll be a strong addition to the team and provide the right balance of strategic thinking coupled with a practical hands-on approach to leading the developers and technical staff.”

Chris Smith said: “This is an exciting challenge and one that I am very much looking forward to. ALMIS® International is a hugely successful software firm operating in an area of the financial sector bound by extensive governance, risk, and compliance. This is a tremendous opportunity. I am very much looking forward to playing a key role in the future success of the company.”

The company is located in central Edinburgh and has a staff complement of 25 staff predominantly in development and technical support.