Industry Leaders share their insights

Following the Prudential Regulatory Authority’s (PRA) recent publication of ‘scenarios for banks and building societies not part of concurrent stress testing‘ our latest webinar with Luke Di Rollo, Chief Product Officer joined by special guests Nick Lock, former Senior Advisor at the Bank of England, and Simon Garrett, Director at ALM Financial Solutions, explored the published scenarios in more detail, the incentives of the regulator, and how non-systemic firms could use these to add value to their internal risk analysis.

- There is a growing critical role for stress testing as part of the supervisory process, specifically in measuring the resilience of individual banks and building societies with a particular focus on capital and liquidity. These scenarios build on the incumbent model by providing a wider audience with a tool to benchmark the types and severity of economic shocks that are expected to be considered.

- With reference to the Supervisory Statement on the ICAAP and supervisory review and evaluation process (SREP), it is essential to understand that all firms are responsible for designing their own stress tests. By publishing two differing scenarios, the PRA’s aim is to encourage firms to consider the type, characteristics and severity of stress that their business model is vulnerable to. This means that Banks and Building Societies should consider the scenarios, which depict a series of macroeconomic dynamics, within the context of their business and specific risk drivers.

- Historically, stress testing has been subverted into a compliance exercise with the regulator demanding an ICAAP document in which specific stresses are run – institutions take the parameters in the stress test, run them against their business to produce an output and the supervisor tells them what their capital requirement is. Ideally what would happen is that each firm thinks about its own risks and risk drivers and stress test for those, which may be based off reverse stress testing to know which areas they are most vulnerable or are most material.

- The instructions outlined by the PRA signal a transition to a more effective framework, which incorporates effective risk management at an individual and encourages firms to optimise their management of capital or liquidity. More emphasis is placed on the ‘internal’ and ‘process’ aspects of the ICAAP, while also satisfying the PRA’s requirement of a minimum requirement on a consistent basis. While banks have a deep understanding of their own business models and customer behaviours, what is particularly valuable here is the credible external assessment of the macroeconomic parameters provided by the PRA. This external perspective ensures a comprehensive approach to stress testing, incorporating broader economic factors that banks might overlook.

Reviewing the scenarios for non-systemic banks

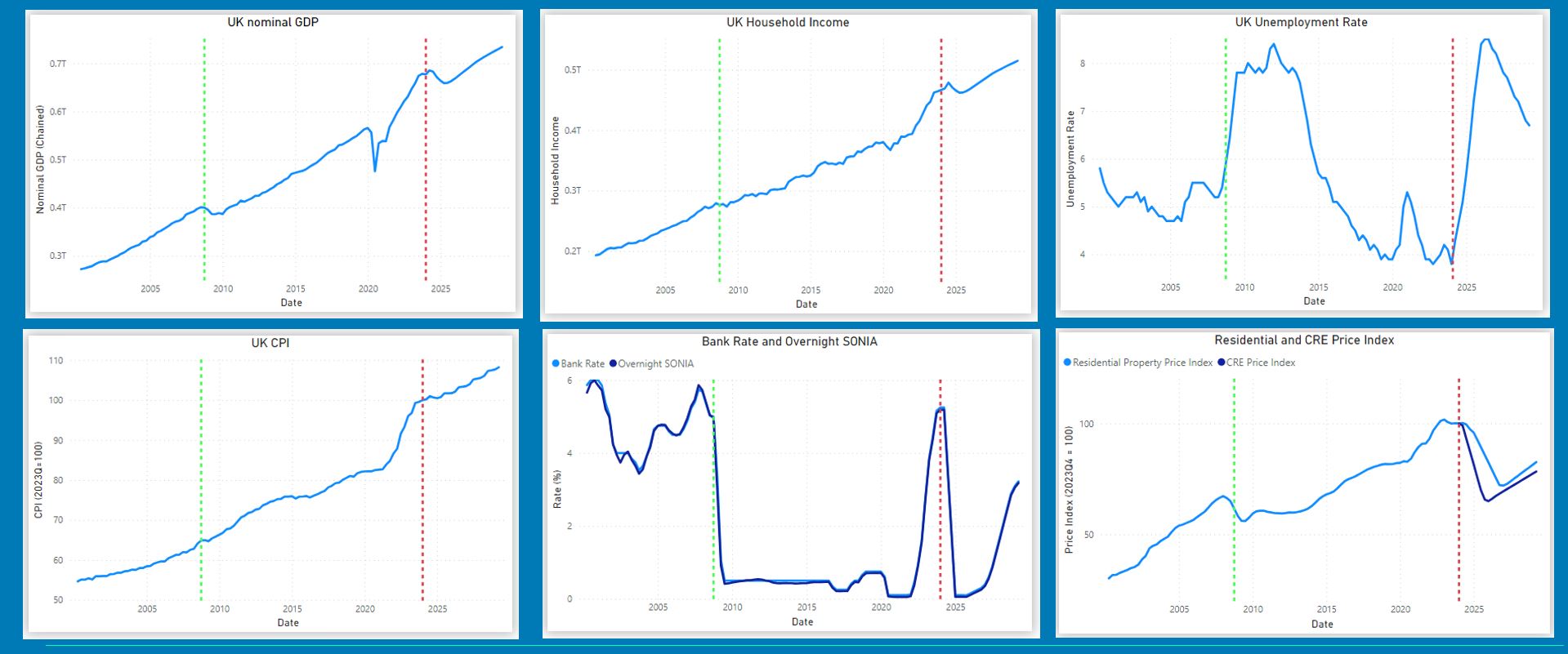

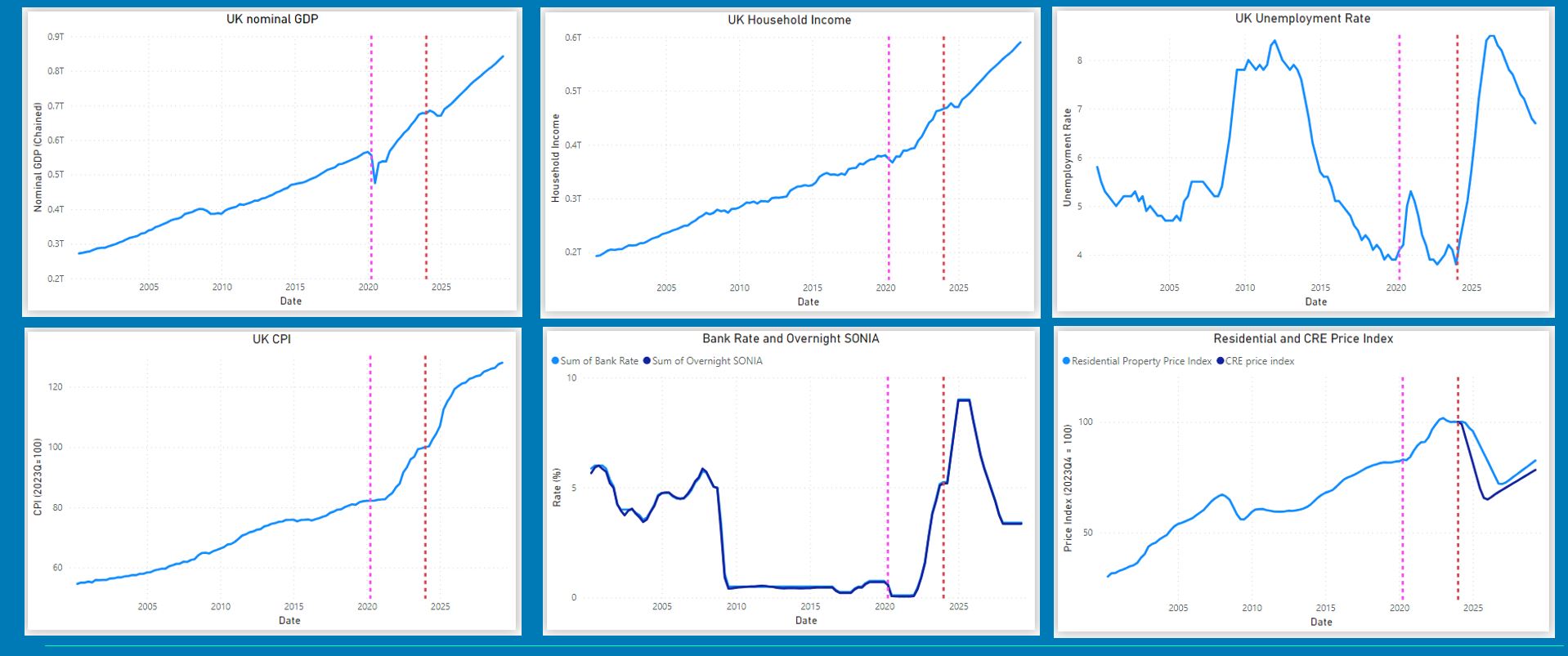

The scenarios for non-systemic banks and building societies are the same as those used for the concurrent stress test. Both scenarios are designed to be severe and broad enough to assess the resilience of the UK banking system. Within each scenario there is a domestic and global recession, with UK GDP falling by 5%, unemployment rising to 8.5%, and house prices falling by 28%. World GDP falls by 3%. The macroeconomic scenario results in sharp moves in other asset prices. There are assumed to be further falls in UK and global commercial real estate (CRE) prices, equity prices fall, government bond term premia rise, and corporate bond spreads widen.

The demand shock scenario sees a severe negative global aggregate demand shock and global recession, resulting in falling inflation. This prompts Bank Rate to fall rapidly from 5.25% to 0.1%, remaining below 0.5% for two years, to support the recovery and return inflation to target.

The supply shock scenario sees a severe, negative global aggregate supply shock from an increase in geopolitical tensions and global commodity prices and supply-chain disruptions. This leads to higher-than-expected inflation across advanced economies. High inflation is assumed to lead to expectations of higher inflation in the future and global policymakers increase interest rates to bring inflation back to target. In this scenario, Bank Rate rises to 9% and stays there for a year.

Can firms use this opportunity to develop one suite of stress scenarios that can be used as part of ICAAP, ILAAP, Recovery Planning and Operational Resilience?

“I was keen to get Nick’s perspective on whether firms could use this opportunity to develop one suite of stress scenarios that can be used for as part of ICAAP, ILAAP, Recovery Planning and Operational Resilience. From my experience working with a majority of the target audience, stress testing has become a myriad of distinct and overlapping exercises, which Simon reiterated. There was unanimous agreement on a systematic approach to stress testing at an institution level, but I appreciate the management actions forming part of a stress test are nuanced, and where management actions to protect capital are likely to deviate from that in a liquidity stress. Or that there are some idiosyncratic type liquidity shocks that aren’t necessarily balance sheet driven and more akin to your funding model.

Having taken time to digest the discussion I am reminded of a UK ALMA presentation many years ago where it was suggested that the global financial crisis was exacerbate by a failure of imagination – to think critically of the specific risks inherent within the financial system or one’s individual balance sheet. Nick’s experience as a supervisor over many years is that firms tend to be very good at projecting upsides but not so good at thinking about where they could go wrong, and so having modelling capability that you can plug new inputs or separate the extras are really important to manage the business. ‘Imagination’ and modelling capability really need to go hand in hand for this to be realised.” Luke Di Rollo

We now have a proxy for the severity of the stress but how does it apply to my balance sheet and where do you start when designing internal scenarios?

Having spent a decade working with banks and building societies on their risk model designs Simon’s recommendation is to start with the corporate plan. This should have an approximate 5-year time horizon, sufficient periodicity to ensure no inter-period risk, and appropriate granularity to allow the flex of business assumptions. Overlaying the macroeconomic parameters provided by the PRA, can lead to spurious assumptions and so it is helpful to consider the key business metrics in context of the stress:

In conclusion, the Prudential Regulatory Authority’s recent scenarios offer a valuable framework for banks and building societies to enhance their internal risk assessments and ensure resilience in the face of economic uncertainties.

By integrating these scenarios into their internal risk management processes, institutions can better prepare for potential shocks, aligning their capital and liquidity strategies with both regulatory expectations and their unique business models.

Adopting a proactive and tailored risk management approach encourages a deeper understanding of individual risk drivers and the potential impact of various stress factors, fostering a culture of resilience and strategic foresight within the industry.

Start with the corporate plan to incorporate the PRA’s macroeconomic parameters in a nuanced manner provides a clear pathway for institutions to develop comprehensive and effective stress testing frameworks. By leveraging these scenarios and maintaining a balance between regulatory compliance and internal risk management, banks and building societies can navigate the complexities of today’s financial landscape with greater confidence and stability.

Successful stress testing is not merely about meeting regulatory requirements but about fostering a deeper, more imaginative approach to understanding and mitigating risks. By doing so, financial institutions can not only comply with regulatory standards but also enhance their strategic decision-making, ensuring long-term sustainability and resilience in an ever-evolving economic environment.

About the Author

Luke Di Rollo, Chief Product Officer, is a seasoned professional in the banking industry with nearly a decade of experience specialising in Asset and Liability Management (ALM) and Interest Rate Risk in the Banking Book (IRRBB). Throughout his career, he has developed and implemented several widely adopted models within the UK banking sector. Luke holds a CertBALM qualification and is a member of the Association of Corporate Treasurers (ACT), underscoring his expertise and commitment to the field.

ALMIS® International has a team of experts in bank Asset Liability Management, Regulatory Reporting, Hedge Accounting and Treasury Management supporting over 65 Financial Institutions. Please get in touch to learn more about how we can help