Enhance the efficiency of your treasury operations, increase visibility and control

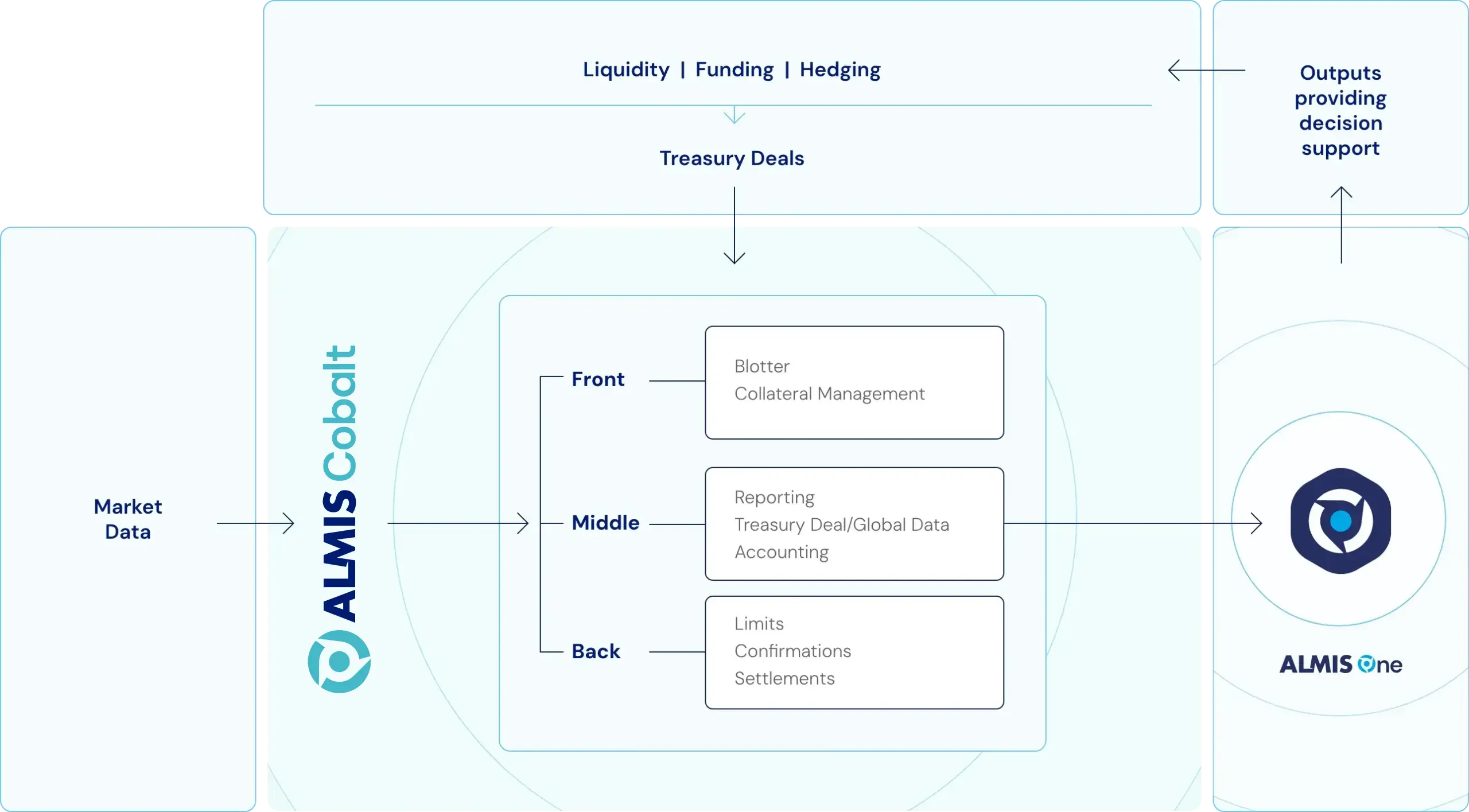

ALMIS® Cobalt is our bespoke banking Treasury Management system, designed to provide treasury insights as the market changes.

Robust & Secure Platform

Captures a detailed log of user activity for Audit, as well as a secure single sign-on with encrypted database ensures your data is safe and protected.

Actionable insights

Real-Time Limits & Exposure Calculations

- Monitor your financial exposure and enforce risk limits in real-time. Cobalt provides instant visibility into limit utilisation, helping you proactively manage risk and ensure compliance with internal policies and regulatory requirements.

Derivative Valuations

- Accurately value your derivative portfolio with Cobalt’s advanced valuation engine. Gain real-time insights into the performance and fair value of complex instruments, ensuring precise financial reporting and informed decision-making.

Cashflow Forecasting

- Predict and plan for future cash needs with robust forecasting tools. Cobalt offers detailed, scenario-based cashflow projections to help you maintain liquidity, optimise funding, and mitigate potential shortfalls.

Yield Optimisation

- Maximise returns on your investments with intelligent yield optimisation. Cobalt analyses market opportunities and your asset portfolio to recommend strategies that enhance yield while aligning with your risk appetite.

Market Trend Analysis

- Stay ahead of the curve with Cobalt’s market trend insights. Analyze real-time and historical data to identify patterns and make informed strategic decisions, reducing uncertainty in volatile markets.

Collateral & Counterparty Exposure Reporting

- Effectively manage counterparty risk and collateral positions. Cobalt provides comprehensive reports and dashboards that track exposures, ensuring compliance and protecting your organization from potential financial losses.

Time-saving automations

Integration with Call, Current & Nostro Accounts

- Streamline your cash management processes by integrating seamlessly with various account types. Cobalt provides real-time visibility into balances and transactions, simplifying reconciliation and optimising liquidity.

General Ledger (Accounting) Integration

- Automate and simplify your accounting processes with Cobalt’s general ledger integration. Ensure accurate, timely financial reporting with seamless data flow between treasury and accounting systems.

Market Data System Connectivity

- Connect directly with market data sources for up-to-the-minute information. Cobalt’s integration ensures accurate pricing, valuations, and risk assessments based on real-time market data.

Penny-Perfect Accruals & Settlement Calculations

- Eliminate discrepancies with precise accrual and settlement calculations. Cobalt automates complex calculations, ensuring accuracy down to the last penny and improving operational efficiency.

Automated Limit Breach Notifications

- Stay informed and responsive with automatic alerts for limit breaches. Cobalt notifies key stakeholders in real-time, enabling quick action to mitigate risks and ensure compliance.

Payment System Integration

- Enhance operational efficiency with seamless payment system integration. Cobalt automates payment processes, reducing manual effort and minimising errors in high-volume transactions.

Comprehensive Audit & Treasury Controls

- Ensure compliance and operational integrity with built-in audit and control features. Cobalt provides detailed logs and automated checks, supporting transparency and robust governance in treasury operations.

Saved us a lot of time

I really like the new reporting functionality in Cobalt. In the past, reports came in a standard format and we had to export and manipulate them quite a bit in Excel. Being able to “drag and drop” as well as add and remove columns/grouping levels and save all these customisations has saved us a lot of time.

Chris Till, Financial Risk Manager

The Marsden

Who we work with

Social