Asset Liability Management

Market leaders in controlling financial risk ALMIS® cloud solutions deliver high-performance, availability and the ability to scale easily

Key features

Capital Adequacy

- Designed for reporting and analytics on the adequacy of capital resources (standardised approach) and related topics

- Detailed calculations showing minimum capital requirements including original exposures and risk-weighted exposures, Own Funds and capital ratios

- Large exposures reporting

- Reporting on counterparty risk by sector and country CVA risk reporting

- Loan to Value reporting

Liquidity

- Enables evaluation of and extensive reporting on liquidity risk including liquidity stress functionality covering a wide range of risk factors to build stress scenarios.

- Extensive liquidity reporting including user-friendly standard reports based upon key regulatory returns (eg cashflow mismatch report)

- Configurable liquidity stress functionality

- Run from any balance sheet portfolio, past present or future

- Configurable stress periods

Market Risk

- helps you evaluate and report on interest rate risk in the banking book and foreign exchange rate risk

- A full range of interest rate risk and FX reporting and analysis in accordance with latest BASEL 3 and EBA guidance covering EVE and NII shocks and sensitivities

- Pre-payment and other behavioural inputs

- Comprehensive gap and basis risk

Financial Planning

- A tool which can project balance sheet forward with user defined assumptions. Enables you to create complex balance sheet and income simulations quickly

- Unlimited number of plans, forward income and balance sheet projections

- Variance analysis against actuals or prior plans

- Dedicated product follow-on functionality

- Drill-down to detailed breakdown of margin movements

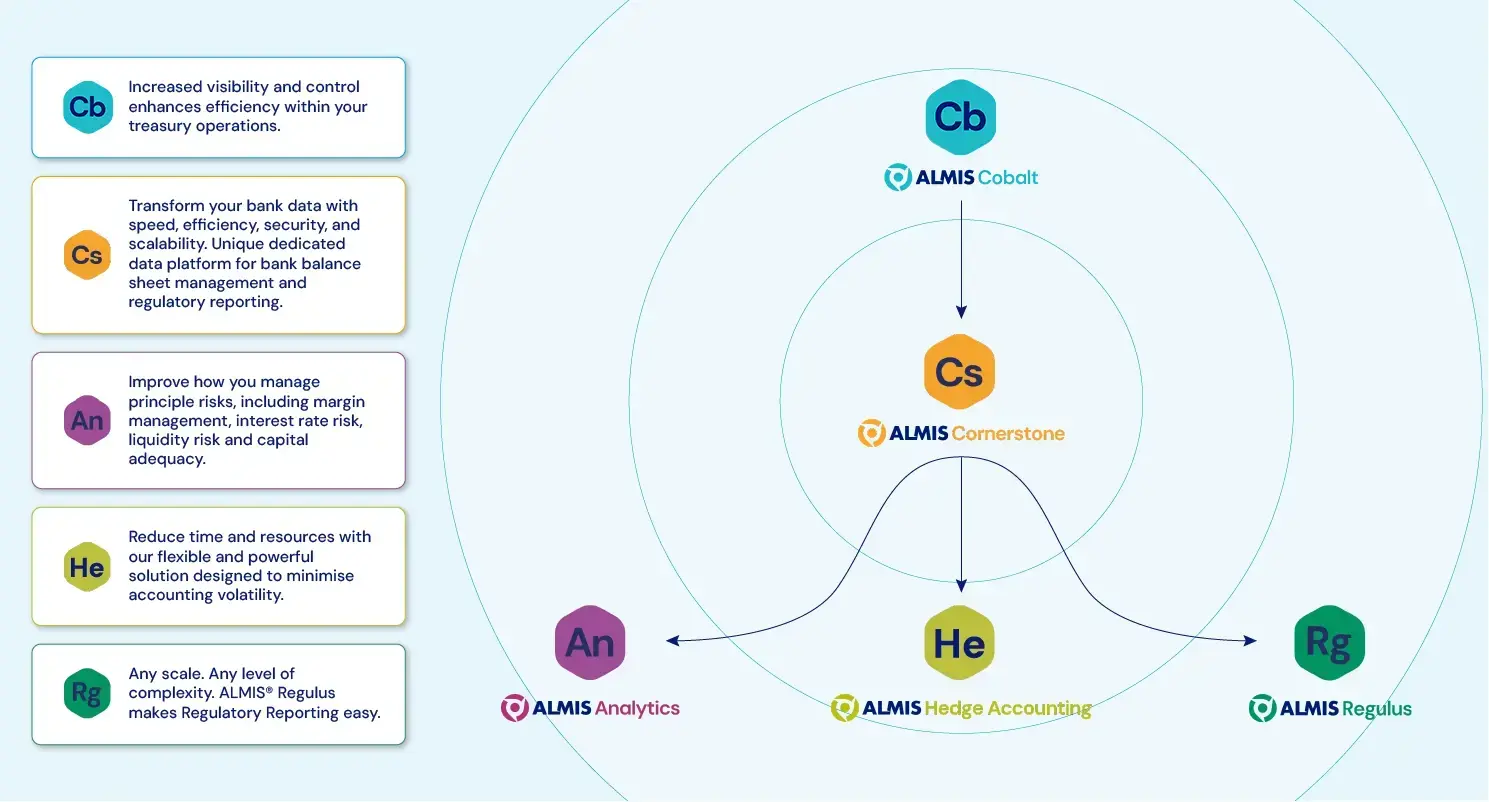

The power to build the right ALM solution for you

Choose any combination of ALM functionality to meet your institutions specific needs.

Trusted Assurance

- Fully compliant with the industry’s changing regulatory reporting requirements

- ALMIS® delivers trusted assurance that banks rely on when dealing with national and international regulators

Single source of truth for Executive stakeholders

- Delivers insights into the Banks financial risks and balance sheet positions

- Enabling the treasury team and banks’ ALCO to make the most informed decisions

Data-led integrated solutions

- Enable seamless integration with our treasury management solution – ALMIS® Cobalt

Bespoke implementation & training

- Experienced ALM/Treasury specialists deliver implementations using our unique ALMIS® implementation methodology (AIM) and project management framework

Customers first

- Agile customer support and deep understanding of current and future end-user needs

- Customers are at the heart of ALMIS. We engage frequently with ALMIS® user groups understanding how they use the product to prioritise future needs

![]()

Software that solves your problem

Seamless integration

Who we work with

Support Services

Proud to help Tipton & Coseley Building Society with regulatory reporting.

One of the benefits of the ALMIS® solutions is that they use a single source of data ensuring consistency of information when we’re using it for treasury risk management, hedge accounting, regulatory reporting or forward forecasting. ALMIS International have an in-depth understanding of our industry and are continually looking at ways they can enhance their products and help their clients as the regulations change.

Andy Lumby, Finance Director

The Tipton